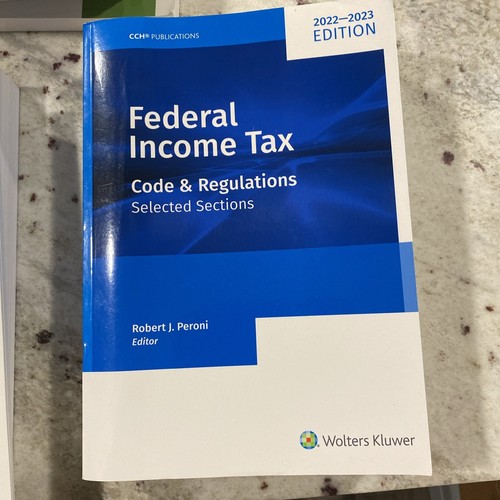

FEDERAL INCOME TAX: CODE AND REGULATIONS--S

US $28.00

Condition:

Like New

A book that looks new but has been read. Cover has no visible wear, and the dust jacket (if applicable) is included for hard covers. No missing or damaged pages, no creases or tears, and no underlining/highlighting of text or writing in the margins. May be very minimal identifying marks on the inside cover. Very minimal wear and tear. See the seller’s listing for full details and description of any imperfections.

Oops! Looks like we're having trouble connecting to our server.

Refresh your browser window to try again.

Shipping:

Free USPS Media MailTM.

Located in: Key Largo, Florida, United States

Delivery:

Estimated between Mon, Jun 2 and Sat, Jun 7 to 94104

Returns:

Seller does not accept returns.

Payments:

Special financing available. See terms and apply now- for PayPal Credit, opens in a new window or tab

Earn up to 5x points when you use your eBay Mastercard®. Learn moreabout earning points with eBay Mastercard

Shop with confidence

Seller assumes all responsibility for this listing.

eBay item number:116294210367

Item specifics

- Condition

- Brand

- Unbranded

- Type

- ABIS_BOOK

- PublicationName

- ABIS_BOOK

- Mpn

- 0808057340

- Topic

- Taxes

- ISBN

- 9780808057345

- Publication Year

- 2022

- Format

- Trade Paperback

- Language

- English

- Book Title

- Federal Income Tax: Code and Regulations--Selected Sections (2022-2023)

- Publisher

- Toolkit Media Group

- Number of Pages

- 1776 Pages

About this product

Product Identifiers

Publisher

Toolkit Media Group

ISBN-10

0808057340

ISBN-13

9780808057345

eBay Product ID (ePID)

22057253487

Product Key Features

Book Title

Federal Income Tax: Code and Regulations--Selected Sections (2022-2023)

Publication Year

2022

Number of Pages

1776 Pages

Language

English

Format

Trade Paperback

Additional Product Features

Intended Audience

Trade

Synopsis

CCH's Federal Income Tax: Code and Regulations--Selected Sections provides a selection of the Internal Revenue Code and Treasury Regulations pertaining to income tax. This popular volume reflects the collective judgment of seven distinguished tax teachers and provides an effective mix of official materials for individual and business undergraduate and graduate tax courses offered in law and business schools. It provides in one volume, the provisions most commonly addressed in income tax courses. The book's highly readable 7-1/2 x 10 oversized page format makes it easy to use for both professor and student. The book is an attractive alternative to the full text of the multi-volume Internal Revenue Code and Income Tax Regulations. Special features of this volume include: - Inclusion of regulations implementing changes made by recent tax legislation - Convenient shortcut table for computation of corporation income taxes - All Code sections that are indexed for inflation are flagged and cross-referenced to material providing the CPI-adjusted numbers - Many Regulations sections that have not been updated by the Treasury to reflect legislation are flagged - Every Code section page carries a footer indicating the specific Code subsection carried on the page--for example, Sec. 271(e) - Every Regulations section page carries a footer indicating the specific Regulation subparagraph carried on the page--for example, Reg. Sec. 1.706-1(c)(3) The 2021-2022 Edition is completely revised to reflect all legislation and regulations enacted or adopted on or before June 1, 2021, and other significant developments that took place throughout the year. It is edited by Robert J. Peroni, the Fondren Foundation Centennial Chair for Faculty Excellence at University of Texas School of Law, and it reflects the tradition of CCH accuracy and completeness. Copies will be published and shipped to arrive at school bookstores and adopters by August 2021 Editorial Board Robert J. Peroni, Coordinating Editor, Fondren Foundation Centennial Chair for Faculty Excellence, University of Texas School of Law Anne L. Alstott, Jacquin D. Bierman Professor of Taxation, Yale Law School Karen B. Brown, Theodore Rinehart Professor of Business Law, The George Washington University Law School Karen C. Burke, Richard B. Stephens Eminent Scholar Chair in Taxation and Professor of Law, University of Florida Levin College of Law Stephen W. Mazza, Dean and Professor of Law, University of Kansa School of Law Gregg D. Polsky, Francis Shackelford Distinguished Professor in Taxation Law, University of Georgia Law School Katherine Pratt, Professor of Law and Sayre Macneil Fellow, Loyola School of Law, Loyola Marymount University

Item description from the seller

Seller feedback (39)

- r***s (41)- Feedback left by buyer.Past 6 monthsVerified purchasePin came very well packaged and a great price. Shipping was very fast and the description and photos were 100% accurate. I highly recommend this seller

- r***1 (22)- Feedback left by buyer.Past 6 monthsVerified purchaseBest packaging I have ever received, perfect condition looked almost never worn, quality was excellent and appearance was beautiful - incredible value I would buy againBarbour Vintage Vest Men’s Size M (#116388428227)

- 9***o (113)- Feedback left by buyer.Past 6 monthsVerified purchaseItem delivered just like it was describedALABAMA JACK'S WHITE RASHGUARD LONG SLEEVE SHIRT FLORIDA KEYS ADULT SMALL (#116290307637)

More to explore :

- Nonfiction Taxes Paperbacks Books in English,

- Nonfiction Books in English Fiction & Taxes,

- Business, Economics & Industry Nonfiction Taxes Hardcovers Books,

- Business, Economics & Industry Taxes Nonfiction Paperbacks Books,

- Business, Economics & Industry Nonfiction Taxes Fiction & Nonfiction Books,

- Business, Economics & Industry Nonfiction Taxes Signed Fiction & Nonfiction Books,

- Business, Economics & Industry Nonfiction Taxes Large Print Fiction & Nonfiction Books,

- Medical Coding Books,

- Business, Economics & Industry Nonfiction Books & Fiction Taxes 1950-1999 Publication Year,

- Business, Economics & Industry Nonfiction Books & Fiction Taxes 1700-1799 Publication Year